“The era of 18% growth rates is probably over.” 1

It's 6%.

Hot off the presses (or email distribution lists)! The [U.S.] Brewers Association —"the trade association representing small and independent American craft brewers"— has released its 2016 data for 'craft' breweries and, by extension, the product they produce, commonly called 'craft' beer. 2

The data show that the state of American 'craft' breweries —although not as good as it has been in the past— is still good.

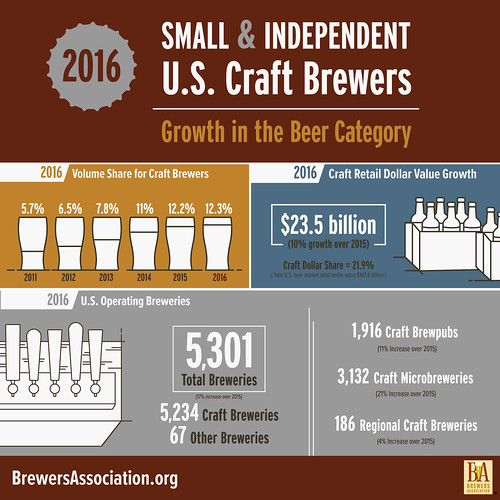

Boulder, CO • March 28, 2017—The Brewers Association (BA)——today released 2016 data on U.S. craft brewing growth 3. With over 5,300 breweries operating during the year, small and independent craft brewers represent 12.3 percent market share by volume of the overall beer industry.

In 2016, craft brewers produced 24.6 million barrels 4, and saw a 6 percent rise in volume on a comparable base 5 and a 10 percent increase in retail dollar value. Retail dollar value was estimated at $23.5 billion, representing 21.9 percent market share. By adding 1.4 million barrels, craft brewer growth outpaced the 1.2 million barrels lost from the craft segment, based on purchases by large brewing companies. Microbreweries and brewpubs delivered 90 percent of the craft brewer growth.

“Small and independent brewers are operating in a new brewing reality still filled with opportunity, but within a much more competitive landscape,” said Bart Watson, chief economist, Brewers Association. “As the overall beer market remains static and the large global brewers lose volume, their strategy has been to focus on acquiring craft brewers. This has been a catalyst for slower growth for small and independent brewers and endangered consumer access to certain brands. Small and independent brewers were able to fill in the barrels lost to acquisitions and show steady growth but at a rate more reflective of today’s industry dynamics. The average brewer is getting smaller and growth is more diffuse within the craft category, with producers at the tail helping to drive growth for the overall segment.”

Additionally, in 2016 the number of operating breweries in the U.S. grew 16.6 percent, totaling 5,301 breweries, broken down as follows: 3,132 microbreweries, 1,916 brewpubs, 186 regional craft breweries and 67 large or otherwise non-craft brewers. Small and independent breweries account for 99 percent of the breweries in operation. Throughout the year, there were 826 new brewery openings and only 97 closings. Combined with already existing and established breweries and brewpubs, craft brewers provided nearly 129,000 jobs, an increase of almost 7,000 from the previous year.6

-----more-----

- Full press release from the [U.S.] Brewers Association: Steady Growth for Small and Independent Brewers (28 March 2017).

- 1 Bart Watson, chief economist for [U.S.] Brewers Association, as quoted during a follow-up "Tele-Press Conference: Annual Craft Brewing Growth Statistics," conducted after the release of the 2016 data. Further analysis from Mr. Watson: Breaking Down the Craft Growth Numbers (28 March 2017).

- 2 There is no legal definition for 'craft' beer or 'craft' brewery and, in fact, the [U.S.] Brewers Association itself has no definition for 'craft' beer. It does, however, define its members as 'craft' breweries, using three criteria:

An American craft brewer is small, independent and traditional.

- Small:

Annual production of 6 million barrels of beer or less (approximately 3 percent of U.S. annual sales). Beer production is attributed to the rules of alternating proprietorships. - Independent:

Less than 25 percent of the craft brewery is owned or controlled (or equivalent economic interest) by an alcoholic beverage industry member that is not itself a craft brewer. - Traditional:

A brewer that has a majority of its total beverage alcohol volume in beers whose flavor derives from traditional or innovative brewing ingredients and their fermentation. Flavored malt beverages (FMBs) are not considered beers.

- Small:

- 3 Data methodology:

Absolute figures reflect the dynamic craft brewer data set as specified by the craft brewer definition. Growth numbers are presented on a comparable base. For full methodology, see the Brewers Association website.

- 4For reference, a barrel of beer is not a physical container like a keg. Rather, it's a unit of volume measurement equal to thirty-one U.S. gallons. To complicate matters, a brewery's sales output will often be reported in "CEs," or "case equivalents." Read more: here.

- 5 Volume by craft brewers represents total taxable production (as reported to the TTB, the Alcohol and Tobacco Tax and Trade Bureau of the U.S. Department of the Treasury.

- 6 These data from the BA are preliminary. It will release a more extensive analysis during the Craft Brewers Conference & BrewExpo America® in Washington, D.C. from April 10-13. It will ppublish its full 2016 industry analysis in the May/June 2017 issue of The New Brewer, "highlighting regional trends and production by individual breweries."

- Related:

- The top 50 breweries of 2016 and the top 50 'craft' breweries of 2016, ranked according to sales volumes.

— Via [U.S.] Brewers Association (15 March 2017). - Large 'legacy' 'craft' breweries experiencing sales slowdowns.

—Via Brewbound (20 March 2017). - For some pioneering craft brewers, it’s closing time

—Via Jason Notte (at Marketwatch, 22 March 2017).

- The top 50 breweries of 2016 and the top 50 'craft' breweries of 2016, ranked according to sales volumes.

- For more from YFGF:

- Follow on Twitter: @Cizauskas.

- Like on Facebook: YoursForGoodFermentables.

- Follow on Flickr: Cizauskas.

- Follow on Instagram: @tcizauskas.

No comments:

Post a Comment

Comment here ...