Fun facts: a snapshot of the brewing and craft brewing business in the U.S. and globally.

-

**************

- In 2016, the U.S. beer market totaled $107.6 billion dollars, 0.5% of the entire U.S. gross domestic product ($18.6 trillion).

- By volume in 2015, the U.S. beer industry sold 206.7 million barrels of beer – equivalent to more than 2.8 billion cases of 24-12 ounce servings.

- However, the overall U.S. beer market volume is expected to decline 1.5% this year.

- In 2016, 'craft' beer accounted for $23.5 billion, 0.1% of U.S. GDP.

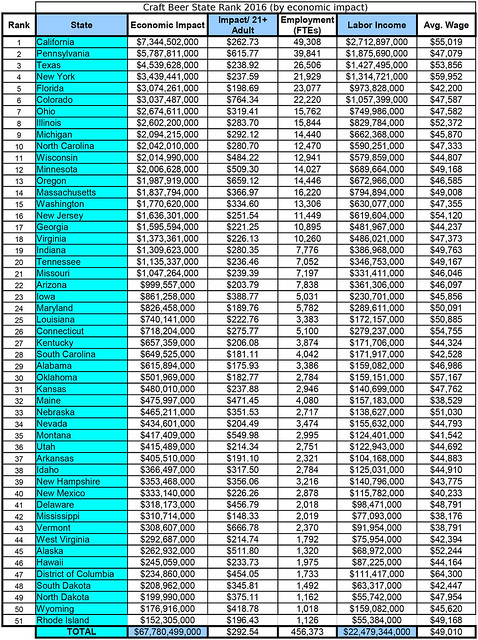

- But, if all related industries are included (retail, wholesalers, suppliers, etc.), the 'craft' brewing industry contributed $67.8 billion to the U.S. economy in 2016.

- 'Craft' beer sales growth is projected to be 8 or 9 percent this year, but that's below the 10 percent pace of 2016.

- 'Craft' beer's volume growth is forecast to be 5 to 6 percent, also below recent double-digit growth.

- This year, that translates to 1.5 million barrels more than in 2016.

- The peak year for 'craft' beer was 2014, when it added 3.3 million barrels.

- Most of the new volume growth for 'craft' this year will come from smaller breweries, not big-name 'craft' brands such as Boston Beer or Sierra Nevada. Larger brands are suffering from a perception of not being authentic 'craft.'

- Grocery chains are not adding total space this year for 'craft' brands.

- 'Craft' beer is forecast to represent about 12 percent of total beer volume this year, up slightly from 2016 levels.

- In 2017, homebrewers will have produced approximately 1.4 million barrels of beer, 1% of all beer produced in the U.S.

- Directly and indirectly, the beer industry employs nearly 2.23 million Americans (including breweries, suppliers, wholesalers, retailers, and importers).

- In 2016, 'craft' breweries, themselves, employed 128,768.

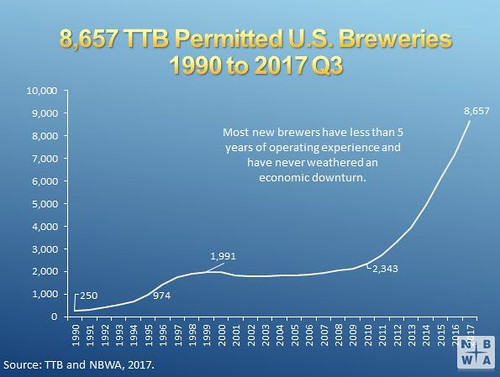

- Nearly 6,000 U.S. breweries are expected to be in operation by the end of this year, up from about 5,300 at the end of 2016. The vast majority of them will be 'craft'(small, independently-oned, and/or locally focused).

- In 1970, there were 4,000 breweries in the world. At the end of 2016, there were 20,000.

- The number of beer brands, worldwide (excluding one-offs), is close to 250,000.

- In 2016, worldwide 'craft' beer sales totaled $85 billion.

- In 2016, consumer preference for beer increased from 42% to 43%, for wine decreased from 34% to 32%, and for spirits decreased from 21% to 20%. 36% of the population does not consume alcohol. (This is an interesting poll result from Gallup. Numerous other media are saying the opposite: that Americans are shifting away from beer to wine and spirits.)

U.S. beer production & sales

**************

Craft beer production & sales

**************

Brewery & beer employment

**************

Total number of breweries

**************